The Real Edge Needs Distributional Skills

|

T.R.E.N.D.S. The Real Edge Needs Distributional Skills |

|

|

![]()

We need trends to survive. Both in life and trading.

But how

to identify trends?

Below you can find my

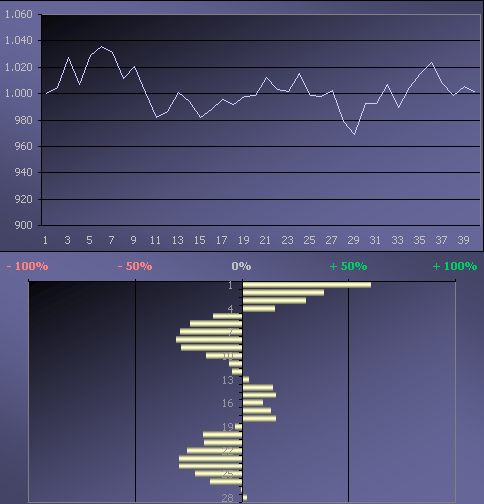

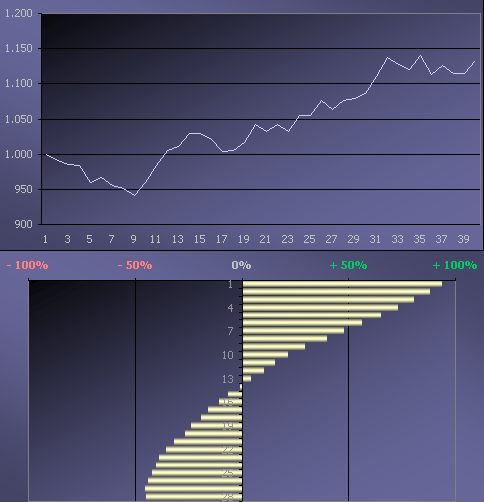

![]() trend indicator (yellow columns) which is quantifying the importance of

a trend component in a time series, i.e. the statistical significance of persistence.

The indicator is calculated with a VBA function (Microsoft Visual Basic for Applications) in Microsoft Excel.

trend indicator (yellow columns) which is quantifying the importance of

a trend component in a time series, i.e. the statistical significance of persistence.

The indicator is calculated with a VBA function (Microsoft Visual Basic for Applications) in Microsoft Excel.

The trend indicator is based on advanced statistics applied

over different time frames, and can range from 0 for no importance to 1 if the series is pure trend.

-

In sideways markets the mentioned trend statistic is erratic

and inconsistent (as a result R squared is low).

-

In trending markets the trend statistic is stable

and consistent (as a result R squared is high).

| sideways market (stay out) | trending market (get in) | |

|

|

Some synonyms:

We should have a method to distinguish between

- random drifts and trends

- noise and trends

- random events/fluctuations/trends and significant

events/fluctuations/trends

- random variation and "true" variation

- deterministic trend and stochastic trend processes

- coincidence and significance

R squared:

R squared (also often referred to as

R², correlation, or coefficient of

determination) is a goodness-of-fit parameter which measures how perfectly a

curve resembles a straight line with no jiggles.

The higher the R squared, the smoother the curve and so the better/desirable the

fit.

Rsquared

can range from 0 for no importance (erratic)

to 1 if the series is pure trend (stable).

A R2 value of about .33 indicates that 33% of the variance in the stock return can

be explained by the data model.

The rest of the stock's variance is due to factors other than the data model.

Beware: R2 is a descriptive measure only for the goodness-of-fit, it is no measure for

the quality of the estimation.

So this is a statistical method to identify trending and nontrending (mean reverting) financial time series.

© Copyright:

|

All rights reserved.

|

|